The 4,000% Question: Is NuScale Power a Revolution or a Rocket Burning Air?

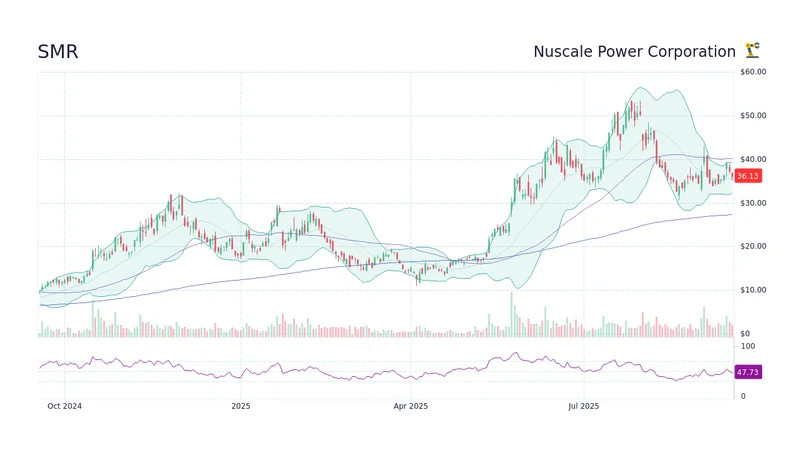

If you’re watching NuScale Power’s stock ticker (NYSE: SMR), you’ve witnessed a masterclass in market momentum. The stock has been on an absolute tear, posting gains that make you check the chart twice. We’re talking about a one-year surge of about 236%—to be more exact, 236.2%. The year-to-date performance is a blistering 158.6% run, a surge that saw SMR shares Hits All-Time High at $53.52 as NuScale Momentum Builds on Landmark SMR Deals | SMR Stock.

On the surface, this is the kind of parabolic move that creates legends. It’s a signal that the market has latched onto a powerful narrative: the dawn of the small modular reactor (SMR) era. NuScale, with its first-mover advantage in U.S. regulatory approval, is positioned as the standard-bearer for a new age of clean, reliable nuclear energy. The story is compelling, clean, and perfectly timed for a world grappling with soaring energy demands from AI and data centers.

But my job isn't to get swept up in the story. My job is to look at the numbers behind the narrative. And when you do that with NuScale, you find a disconnect so profound it forces you to ask a fundamental question: Is the market pricing in a plausible future, or is it betting on a miracle?

The Narrative Engine

You can’t argue with the power of a good story, and NuScale’s is one of the best on the market right now. The primary catalyst for this explosive growth is the landmark agreement with ENTRA1 Energy and the Tennessee Valley Authority (TVA). This isn't some speculative memorandum of understanding; it's a plan targeting up to 6 gigawatts of SMR capacity across TVA's territory.

Let's put that in perspective. Six gigawatts is an immense amount of power (enough to power roughly 4.5 million homes or around 60 new hyperscale data centers). It’s being framed as the largest potential SMR rollout in U.S. history, a powerful validation of NuScale’s technology and business model. This deal single-handedly transformed NuScale from a promising-but-speculative technology play into a company with a visible, large-scale commercial pipeline. Add to that a de-risking transaction with the Department of Energy to acquire reactor materials, and you have a narrative that screams "inevitable."

This story is like a perfectly engineered financial vehicle. It taps directly into the most potent themes driving investment today: the clean energy transition, the insatiable power demands of artificial intelligence, and the reshoring of American energy infrastructure. When a company aligns with macro trends this powerful, investors often stop asking detailed questions. The price action becomes its own justification.

But is that justification sound? Does a historic deal, however promising, warrant the kind of valuation we’re seeing? A great story can make a stock fly, but only real, quantifiable value can keep it from falling back to earth.

The Quantitative Reality Check

This is the part of the analysis where the music stops. While the market is cheering the narrative, the quantitative models are flashing red. A company's value, in the long run, isn't derived from press releases but from the cash it generates. The most common tool for measuring this is the Discounted Cash Flow (DCF) model, which projects a company's future cash flows and discounts them to determine what they're worth today.

For NuScale, the DCF analysis is, to put it mildly, brutal.

The company's most recent Free Cash Flow (FCF) is negative $96.86 million. This isn't surprising for a pre-revenue company investing heavily in growth. What is concerning is the timeline. Analyst projections don't see NuScale generating positive free cash flow until 2029, and even then, it’s a modest $15.25 million. The model extrapolates this out, forecasting a climb to just over $50 million in FCF by 2035.

I've looked at hundreds of these filings, and this particular disconnect is unusual. Based on these cash flow projections—the actual money the business is expected to generate—the DCF model values NuScale shares at just $1.18.

Read that again. The stock is trading above $50, while a standard valuation model based on its own projected earnings suggests it’s worth a little over a dollar. This implies the stock isn't just a little overvalued; it's an estimated 3,782.9% overvalued. This isn't a rounding error or a minor disagreement between bulls and bears. It's a chasm. It's the difference between a company selling blueprints for a skyscraper and being valued as if the building is already complete, fully leased, and generating rent for the next thirty years.

How can a company with a 1-out-of-6 "undervalued" score on basic quantitative checks command such a premium? The market is essentially ignoring a decade of projected cash burn and pricing in not just the successful execution of the TVA deal, but decades of flawless global expansion thereafter. It’s a bet that the narrative is so powerful it will render the current financial reality irrelevant. That’s a very, very dangerous bet to make.

A Tale of Two Valuations

So what's the real story here? The market sees a revolutionary technology at the dawn of its adoption curve, fueled by an AI-driven energy crisis. The math sees a company that won't make a dollar of free cash for another five years and whose current valuation has detached from any recognizable financial anchor. Both can't be right. While the narrative of SMRs powering the future is incredibly appealing, a valuation gap of this magnitude isn't a signal of a bold investment opportunity. It's a fire alarm. The market is pricing in perfection for a company that has yet to deliver a single commercial watt. That’s not investing; it’s faith. And faith is a poor substitute for cash flow.