The ticker tape is bleeding red. The Dow, the S&P, the Nasdaq—all taking a nosedive. Analysts are calling it a “white-knuckle moment,” and I get it. The headlines are screaming about trade wars and hostile moves. For instance, Trump threatens to jack up tariffs on China over its new rare-earth controls, while China is tightening its grip on the one resource that underpins our entire modern world: rare-earth elements.

On the surface, this looks like a disaster. A geopolitical chess match where our most critical technologies—from the iPhone in your pocket to the F-35 fighter jet—are the pawns. It feels like the engine of progress is about to seize up. But I want you to take a breath, step back from the panic, and look at this from a different angle. Because I don't see an ending here. I see a beginning. This isn't the crisis that breaks us; it's the shock to the system we desperately needed to wake up.

The Invisible Foundation of Everything

Let's be brutally honest for a moment. For decades, we’ve built our glittering technological civilization on a foundation we didn't own and didn't control. Rare-earth elements are like the essential vitamins of technology; you only need a tiny pinch of neodymium or terbium, but without them, the entire system—the electric motors, the wind turbines, the hard drives, the missile guidance systems—simply collapses.

And we've allowed one single nation to control up to 95% of the global supply of the most powerful rare-earth magnets. We outsourced not just the messy mining but the complex processing, effectively handing over the keys to the 21st century. What China just did with its new export controls is simply turn that key in the lock. The new rules are incredibly far-reaching—they require special approval for any product containing even trace amounts of their rare earths, even if that product was made in another country by a non-Chinese company. When I first read the details, I honestly just sat back in my chair, a cold feeling washing over me. This isn't a tariff dispute; it's a declaration of absolute supply-chain sovereignty.

This has been a strategic vulnerability hiding in plain sight, a single point of failure for the entire global tech ecosystem. We all knew it was there, but the flow was cheap and easy, so we looked the other way. Now, we can't. The comfortable illusion is shattered. The question is no longer if we should do something about it, but how fast can we reinvent everything?

A Sputnik Moment for Materials Science

Do you remember the oil crises of the 1970s? The long gas lines, the economic pain, the sense of national vulnerability. It was awful. But that crisis forced a revolution. It gave birth to the modern fuel-efficient engine, supercharged research into solar and wind power, and fundamentally changed our relationship with energy. It was a painful, expensive, but ultimately transformative "forcing function."

This is our new forcing function. This is the Sputnik moment for materials science.

For years, brilliant researchers in labs at MIT, Stanford, and across the world have been working on the next generation of materials. They’ve been exploring ways to recycle rare earths from old electronics with near-perfect efficiency, designing new magnet chemistries that don't rely on the rarest of the rare earths, and even engineering advanced materials like carbon nanotubes and graphene that could one day replace them entirely. But this research has always been "important," not "urgent." It lacked the massive, society-wide political and economic will to push it from the lab into mass production.

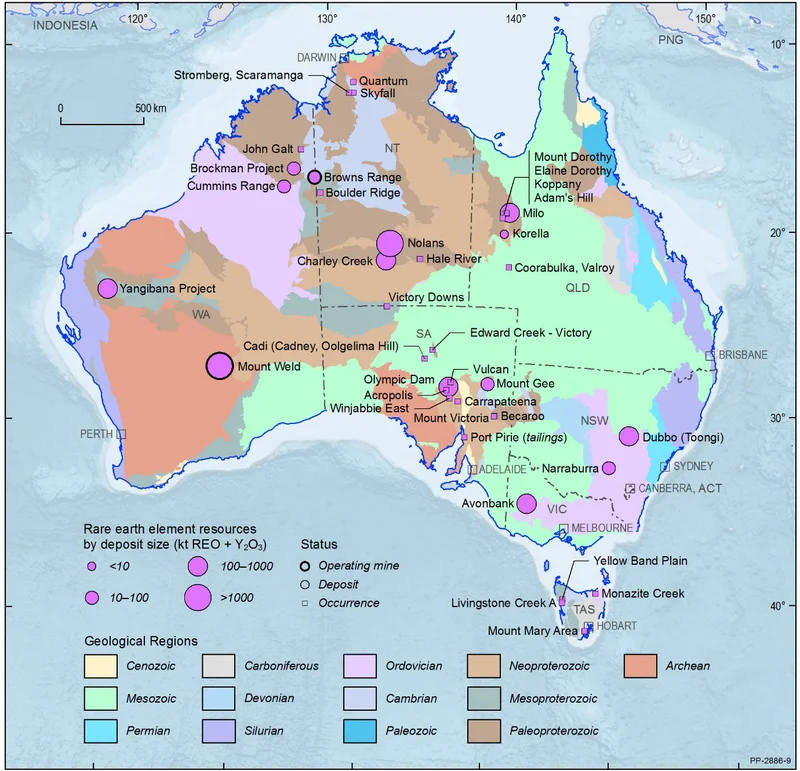

Well, it’s urgent now. This geopolitical squeeze play is the multi-trillion-dollar incentive we needed, and the speed at which capital and brainpower will now flood into this space is going to be absolutely breathtaking—it means we’re about to witness a Cambrian explosion of innovation in the very stuff that builds our world. This isn't just about finding new mines in Australia or the U.S. That's the 20th-century solution. This is about inventing entirely new supply chains from the atoms up.

What if this isn't the end of an era of easy access, but the beginning of an era of true material independence? What if the answer isn't just digging more out of the ground, but creating a truly circular economy where the rare earths in your old phone become the engine for your new electric car?

The Painful Push We Needed

Look, the next year or two might be rocky. Markets hate uncertainty, and this is pure, uncut uncertainty. There will be economic pain. But we can't let the short-term reaction of the stock market cloud our vision of the long-term opportunity. This isn't a reason for despair; it's a call to action. It's the catalyst that will finally force us to build a more resilient, more decentralized, and radically more innovative technological future. We were standing on a foundation of sand, and the tide just came in. Now, we finally have the motivation to build on solid rock.